Introduction

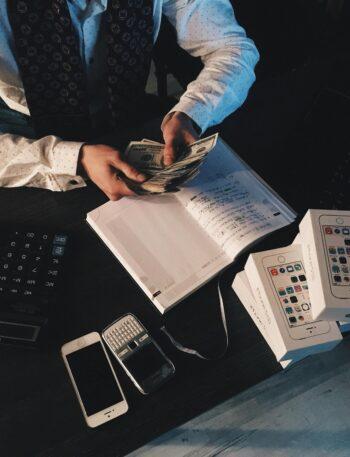

Managing your finances effectively is essential for achieving long-term security and peace of mind. Unfortunately, many individuals make financial mistakes that can jeopardize their financial future. Avoiding these common pitfalls can help you build a solid financial foundation and ensure a secure future. Here are the top 10 financial mistakes to avoid and strategies to keep your financial life on track.

1. Neglecting to Budget

A budget is a fundamental tool for managing your finances. Neglecting to create and stick to a budget can lead to overspending and financial instability. Without a budget, it’s challenging to track where your money is going and make informed decisions about saving and investing.financial mistakes.

Solution:

Create a detailed budget by tracking your income and expenses. Categorize your spending into essentials (e.g., rent, utilities) and non-essentials (e.g., dining out, entertainment). Use budgeting tools or apps to help you manage your budget and adjust as necessary. Regularly review your budget to ensure it aligns with your financial goals.

Also Read: /personal-finance-101/

2. Ignoring Emergency Savings

An emergency fund is crucial for financial security. Without sufficient savings set aside for unexpected expenses, such as medical emergencies, car repairs, or job loss, you may be forced to rely on credit cards or loans, leading to debt accumulation.financial mistakes.

Solution:

Build an emergency fund that covers three to six months’ worth of living expenses. Keep this fund in a separate savings account that’s easily accessible. Aim to contribute to your emergency fund regularly, even if it’s a small amount each month.

3. Accumulating High-Interest Debt

High-interest debt, such as credit card debt, can quickly become unmanageable and hinder your financial progress. The high interest rates associated with such debt can lead to substantial financial strain and prolonged repayment periods.

Solution:

Focus on paying off high-interest debt as quickly as possible. Consider using the debt avalanche method, which prioritizes paying off debts with the highest interest rates first. Alternatively, explore debt consolidation options to combine multiple debts into a single loan with a lower interest rate.

4. Neglecting Retirement Savings

Failing to save for retirement is a common financial mistake that can have long-term consequences. Without adequate retirement savings, you may find yourself struggling to maintain your standard of living in your later years.

Solution:

Start saving for retirement as early as possible. Contribute to retirement accounts such as a 401(k) or an IRA. Take advantage of employer matching contributions if available. Regularly review and adjust your retirement savings plan to ensure it aligns with your retirement goals and timeline.

5. Overlooking Insurance Needs

Insurance is essential for protecting yourself and your assets from unexpected events. Neglecting to have adequate insurance coverage can leave you financially vulnerable in the event of accidents, illnesses, or property damage.financial mistakes.

Solution:

Review your insurance needs and ensure you have appropriate coverage for health, auto, home, and life insurance. Assess your policies regularly to ensure they provide adequate protection. Consider additional coverage if you have significant assets or specific risks.

6. Failing to Invest Wisely

Investing is crucial for growing your wealth and achieving long-term financial goals. Failing to invest or making poor investment choices can hinder your ability to build wealth and achieve financial security.

Solution:

Educate yourself about different investment options, such as stocks, bonds, mutual funds, and real estate. Consider your risk tolerance and investment goals when selecting investments. Diversify your portfolio to spread risk and consult with a financial advisor if needed to develop a well-rounded investment strategy.

7. Living Beyond Your Means

Living beyond your means involves spending more than you earn, often resulting in debt and financial stress. This behavior can prevent you from achieving financial stability and reaching your long-term goals.financial mistakes.

Solution:

Adopt a lifestyle that aligns with your income. Avoid relying on credit cards or loans to finance unnecessary expenses. Focus on reducing discretionary spending and prioritize saving and investing. Regularly review your expenses and make adjustments as needed to live within your means.

8. Ignoring Financial Goals and Planning

Without clear financial goals and a plan to achieve them, you may find it challenging to make progress and stay motivated. Lack of planning can lead to missed opportunities and unfulfilled financial objectives.

Solution:

Set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. Create a financial plan that outlines the steps needed to achieve these goals, including budgeting, saving, and investing strategies. Regularly review and update your plan to stay on track and adjust for any changes in your financial situation.

9. Underestimating the Importance of Credit Scores

A good credit score is essential for obtaining favorable loan terms and interest rates. Underestimating the importance of your credit score can result in higher borrowing costs and difficulty accessing credit when needed.financial mistakes.

Solution:

Monitor your credit score regularly and review your credit report for accuracy. Pay your bills on time and keep your credit utilization low. If you have a low credit score, work on improving it by addressing any negative items on your credit report and practicing responsible credit management.

10. Failing to Educate Yourself Financially

Financial literacy is crucial for making informed decisions and managing your money effectively. Failing to educate yourself about personal finance can lead to costly mistakes and missed opportunities.financial mistakes.

Solution:

Invest time in learning about personal finance through books, online resources, and financial education programs. Stay informed about financial trends and updates that may impact your financial decisions. Consider consulting with financial advisors or taking courses to enhance your financial knowledge.

Conclusion

Avoiding these common financial mistakes is essential for building a secure and prosperous financial future. By creating and sticking to a budget, building an emergency fund, managing debt wisely, saving for retirement, and investing intelligently, you can achieve financial stability and work towards your long-term goals. Regularly review your financial situation, educate yourself, and make informed decisions to ensure a secure and fulfilling financial future.